Expert Tips for Protecting Conventional Mortgage Loans with Competitive Prices

Expert Tips for Protecting Conventional Mortgage Loans with Competitive Prices

Blog Article

A Comprehensive Guide to Protecting Home Loan Loans and Navigating the Application Refine Successfully

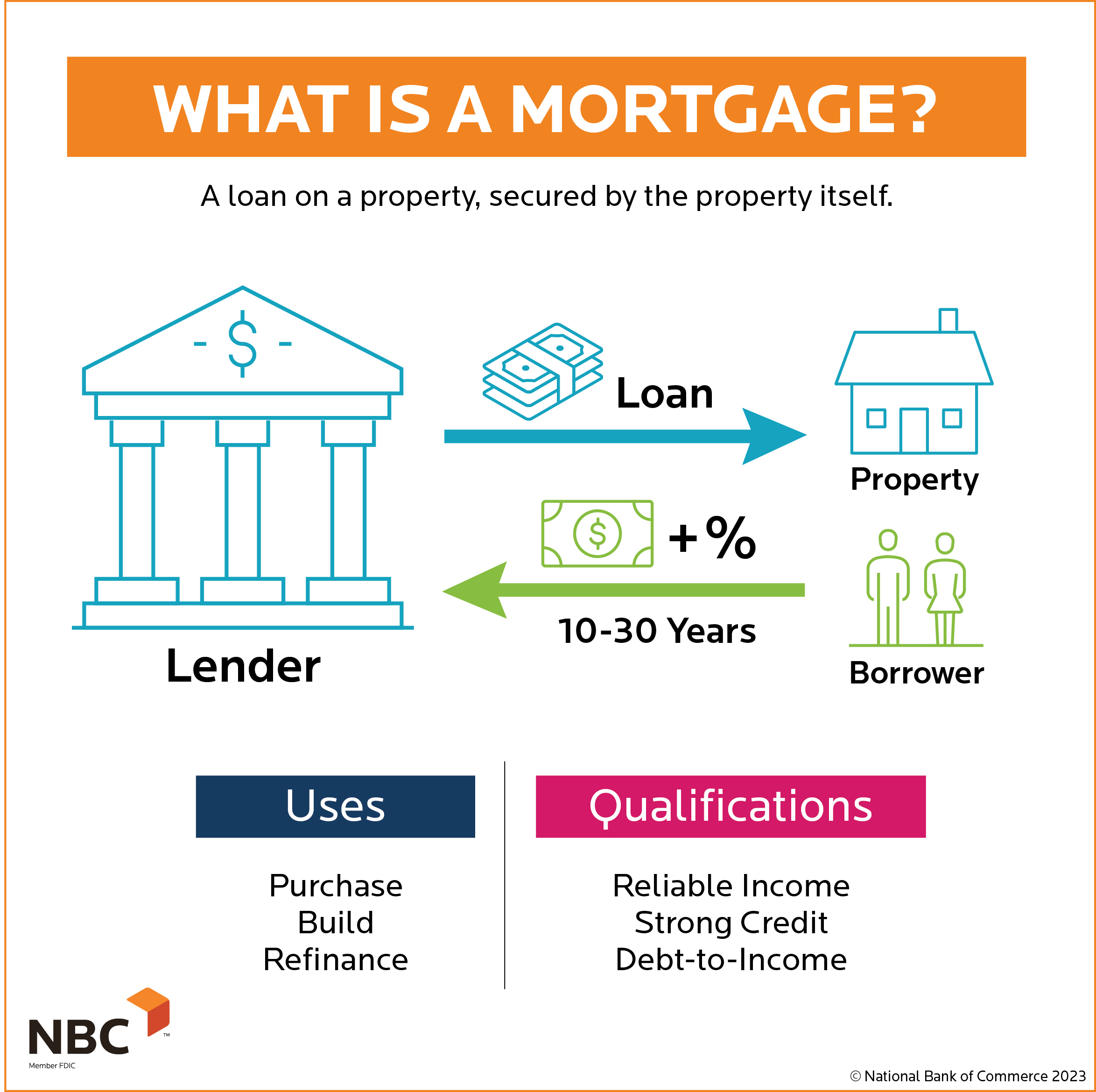

Browsing the complexities of safeguarding a mortgage lending can usually feel frustrating, yet understanding vital elements can significantly boost your chances of success. From reviewing your credit rating to selecting one of the most suitable loan provider, each action plays a vital duty in shaping your home mortgage application experience. As you prepare vital documentation and involve with loan providers, it becomes obvious that tactical preparation is critical. However, the nuances of the application procedure and suggestions for making certain approval can make all the distinction in attaining positive terms. What actions should you prioritize to enhance your trip?

Understanding Your Credit History

A strong understanding of your credit history is essential for navigating the home loan procedure properly. Your credit rating is a mathematical depiction of your credit reliability, normally ranging from 300 to 850, and it significantly affects the terms and problems of your mortgage. Lenders rely upon this score to analyze the danger related to lending you cash.

A number of elements contribute to your credit rating, consisting of payment background, credit application, length of credit report history, sorts of credit score accounts, and recent questions. Repayment history is one of the most important element, as prompt repayments reflect your integrity as a consumer. Preserving a low debt application ratio-- preferably below 30%-- is additionally crucial, as it demonstrates liable credit history management.

Before making an application for a home loan, it is advisable to inspect your credit report for mistakes and challenge any type of mistakes. Improving your rating can take time, so think about approaches such as paying down existing financial obligations, staying clear of new credit report inquiries, and making repayments on time. By comprehending and handling your credit report rating, you can enhance your possibilities of protecting desirable home mortgage terms and ultimately attaining your homeownership goals.

Choosing the Right Lender

Selecting the right lender is a pivotal action in the home loan procedure, particularly after acquiring a clear understanding of your credit rating. The loan provider you choose can dramatically influence your home mortgage experience, from the prices you obtain to the total effectiveness of the application process.

Begin by looking into numerous loan providers, including standard banks, credit history unions, and on the internet mortgage business. Each sort of lender might provide distinctive advantages, such as affordable rates or individualized service. Compare rate of interest, charges, and lending products to recognize lenders that line up with your economic needs.

Furthermore, take into consideration the lender's credibility and customer service. Ask and check out testimonials for recommendations from pals or family members. A lender with a strong track document of consumer complete satisfaction can supply beneficial support throughout the process.

It is likewise vital to evaluate the lender's responsiveness and determination to address your inquiries (Conventional mortgage loans). A transparent and communicative loan provider can aid alleviate tension during this vital time. Inevitably, picking the appropriate lender will certainly enhance your mortgage experience, ensuring you protect positive terms and a smooth application procedure

Preparing Needed Documents

Gathering necessary paperwork is vital for a smooth mortgage application process. The best files offer lenders with a detailed sight of your economic scenario, facilitating quicker approvals and lessening possible hold-ups.

Moreover, it is necessary to collect information concerning your debts, including debt card statements and any type of outstanding finances, to offer lenders a total photo of your financial responsibilities. Last but not least, documentation related to the building you wish to buy or refinance, such as a performed purchase contract or building listing, should also be included.

Being well-prepared can significantly enhance your home loan application experience, making sure that you provide a accurate and complete financial profile to potential lenders.

The Mortgage Application Refine

As soon as the application is sent, the lender will certainly start a credit report check to assess your credit rating score and background. Simultaneously, they may ask for additional documents to confirm your income, properties, and responsibilities - Conventional mortgage loans. This might include current pay stubs, financial institution statements, and tax obligation returns

After examining the application and supporting records, the loan provider will certainly issue a Lending Price quote, outlining the terms, rate of interest, and costs connected with the car loan. This is an essential file pop over to this web-site for comparing deals from various lenders.

Following your approval of the Lending Price quote, the loan provider will carry out a residential property assessment to figure out the home's worth. Ultimately, as soon as all problems are met, the loan will proceed to underwriting, where the last choice on authorization will certainly be made. Understanding these steps is necessary for a smooth home our website mortgage application procedure.

Tips for a Successful Authorization

Following, arrange your monetary paperwork. Gather pay stubs, income tax return, financial institution statements, and any why not try this out type of other pertinent documents that demonstrates your income and monetary stability. This will certainly enhance the application process and show lending institutions that you are an accountable customer.

Additionally, consider your debt-to-income (DTI) proportion. Lenders favor a DTI of 43% or reduced, so concentrate on paying for existing financial obligations to improve your economic profile. It might likewise be advantageous to conserve for a larger deposit, as this can decrease your regular monthly payments and show your commitment.

Last but not least, preserve open lines of communication with your lending institution. Ask concerns to clarify any unpredictabilities and stay notified about your application's progression. By being well-prepared and positive, you can browse the mortgage authorization procedure with confidence and raise your possibility of success.

Verdict

In conclusion, securing a home mortgage funding requires a comprehensive understanding of numerous parts, consisting of credit scores, lending institution option, and documents preparation. By sticking to these standards and maintaining open interaction with loan providers, potential consumers can place themselves for success.

From assessing your credit report rating to choosing the most appropriate loan provider, each step plays an important function in forming your home mortgage application experience.Begin by investigating various lenders, consisting of typical financial institutions, credit rating unions, and online home mortgage business. Eventually, choosing the appropriate lending institution will enhance your home mortgage experience, guaranteeing you protect favorable terms and a smooth application process.

The procedure generally begins with picking a loan provider and completing a home mortgage application, which consists of personal, economic, and employment information.In verdict, protecting a home mortgage finance requires a comprehensive understanding of numerous elements, consisting of debt ratings, lender option, and paperwork preparation.

Report this page